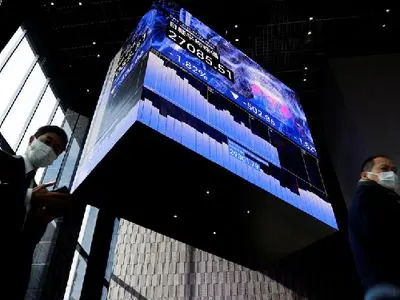

Gains in banks, energy and mining stocks lifted Asian equities a little higher on Tuesday as investors braced for aggressive U.S. rate hikes and war disrupting oil supplies.

oil deal

-

-

OPEC+ agreed on Friday to add more oil to the market from August and extend the duration of their pact on their remaining production curbs for longer, even though the United Arab Emirates still opposed the extension, an OPEC+ source said.

-

Oil pulled back after hitting fresh multi-year highs on Monday, as investors awaited the outcome of this week's talks between Iran and world powers over a nuclear deal that is expected to boost crude supplies.

-

Asian share markets slipped on Friday after a spike in global bond yields soured sentiment toward richly priced tech stocks, while a stampede out of crowded positions may have put an end to the bull run in crude oil.

-

Italian energy major, Eni, described 2020 as a “year of war”, regarding the energy crisis experienced in the face of a global pandemic. But it may be too soon to see the issues faced last year as a thing of the past. Eni is committing to lowering the price of oil at which the company breaks even going into 2021, as a means of tackling the uncertainty of the oil economy in the coming months. Francesco Gattei, CFO at Eni, stated that “Volatility is growing every year.”, highlighting the need to be prepared for the energy demand of the future.

-

Iran's foreign minister, Mohammad Javad Zarif, said that Tehran was closing in on an agreement to sell oil to European nations despite US threats of sanctions against any countries that do business with Iran.